«Will you marry me?» «Yes!», say most people in Switzerland. Almost three quarters of men and women in heterosexual relationships are married. Many seal their love with a wedding. A romantic act and a reason to celebrate. But marriage also has a completely unromantic side: financial and legal consequences.

Anyone who thinks that you can avoid these dry topics without a marriage license is mistaken. The so-called «wild marriage» does not live up to its name. On the contrary: if you are cohabiting, you need to consider your finances, rights and obligations.

Which of the two living arrangements is better? There is no general answer. The scales are in the balance: Security on the one hand and taxes on the other. «A couple should always think carefully about which living arrangement they choose. Which is the better choice depends on the individual situation», says Jennifer Dürst, lawyer and mediator SAV/SKWM.

The choice of living arrangements has consequences. We use five scenarios to show you what precautions should be taken depending on the situation. We accompany Anna and Jonas through life and difficult times. We show them: What if …

… they were married;

… they were cohabiting.

Our couple

Anna (32) and Jonas (34) have been a couple for two years. They live in the city of Zurich. They both work full-time in marketing and communications. Anna has a net salary of 73’000 francs. Jonas earns 81’000 francs net per year. And then life takes its course…

Scenario 1: A harmonious couple until the end

Anna and Jonas remain financially independent. It is clear to them: we will live child-free, advance our careers and spend the rest of our lives together. The plan works.

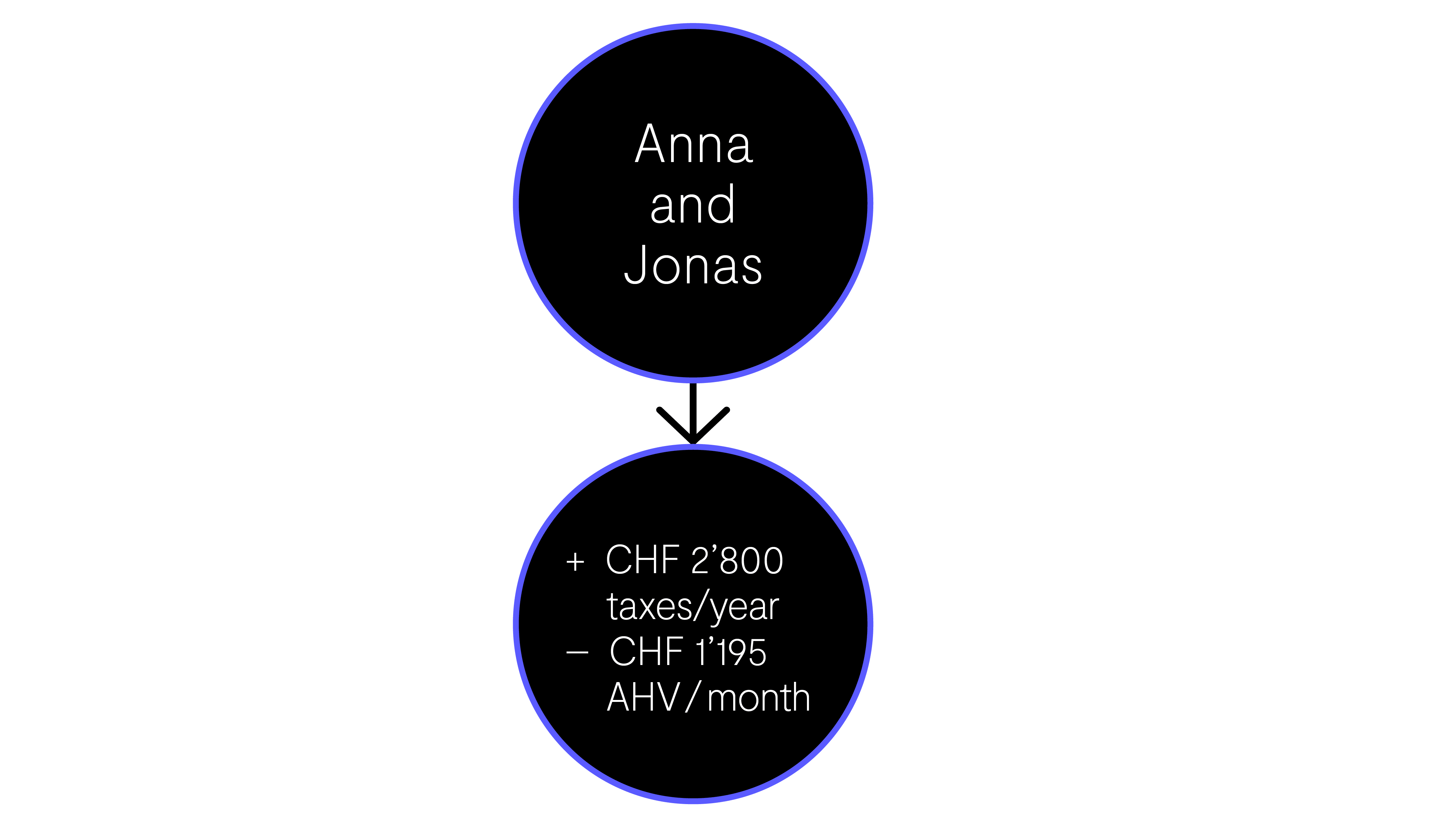

As Anna and Jonas are romantics, they get married. When they receive their first tax bill, however, the romance is over: their income and wealth tax amounts to just under 22,400 francs. Before their wedding, Jonas paid 10,800 francs and Anna 8800 francs, so together they paid 19,600 francs. As a result of the marriage alone, their tax bill is now CHF 2800 higher per year. If they both earn more in the course of their careers, this amount will increase further.

When Anna and Jonas retire, they experience another scary moment. Their AHV pension is lower than if they had not married. Today, as a married couple, they receive a maximum of 3585 francs together. If they were cohabiting, they would each receive 2390 francs, so together they would receive 4780 francs.

Marriage with two full incomes

The expert, Jennifer Dürst, says: «For couples where both earn a full salary and have no children, it is often not worth getting married from a financial point of view. As the incomes of married couples are added together, they end up in a higher progression bracket and have to pay significantly more taxes. Even though they don't earn more. So you need to do your sums carefully.»

Scenario 2: The relationship crumbles and eventually ends

After 15 years, Jonas and Anna realize that they want different things from life. They decide to separate. Jonas is now 49 and Anna is 47. Both are still financially independent and have made a career for themselves. They have no children.

For a married couple, this means that Jonas and Anna are getting divorced. They did not sign a prenuptial agreement when they got married. As a result joint ownership of acquired property is applied. This means that everything they have earned during the marriage or saved through their salary is added up and then divided 50:50. However, what Jonas and Anna have brought into the marriage, inherited during the marriage or received as a gift belongs to them alone.

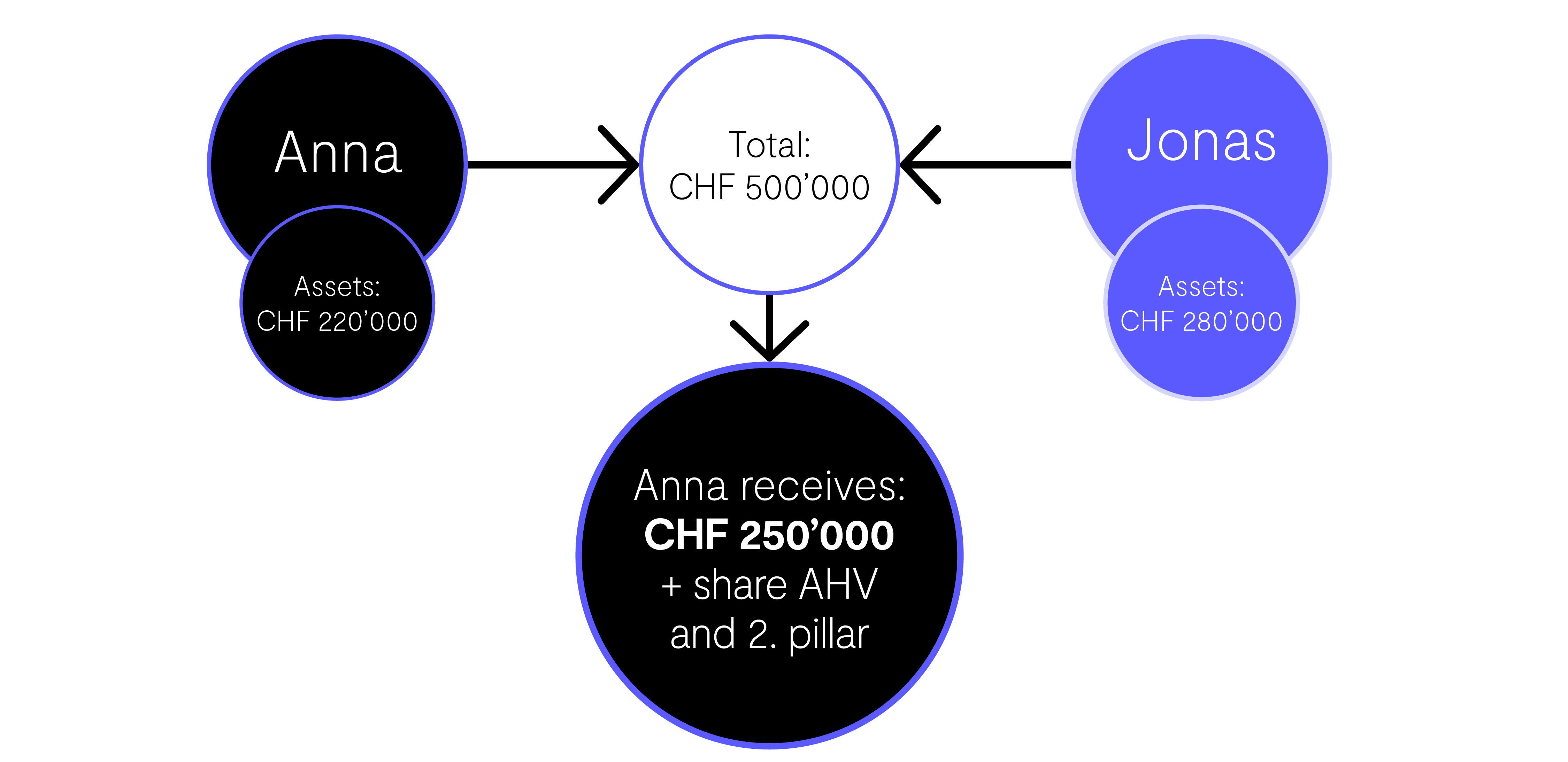

Both Jonas and Anna have made a career during their time together, earned good money and invested some of it. Anna has saved 120,000 francs, Jonas around 180,000 francs. Both also have a pillar 3a, each with around CHF 100,000. Anna's assets at the time of the divorce total CHF 220,000, while Jonas has CHF 280,000. Jonas and Anna will each receive CHF 250,000 from these assets at the time of the divorce. In addition, the assets from the pension fund that Anna and Jonas have saved up during their time together will be divided. For Anna, who has earned slightly less than Jonas all these years, this is a plus for her retirement provision. As Anna and Jonas are financially independent from each other, they will probably not have to pay each other maintenance after the divorce.

Marriage - Divorce

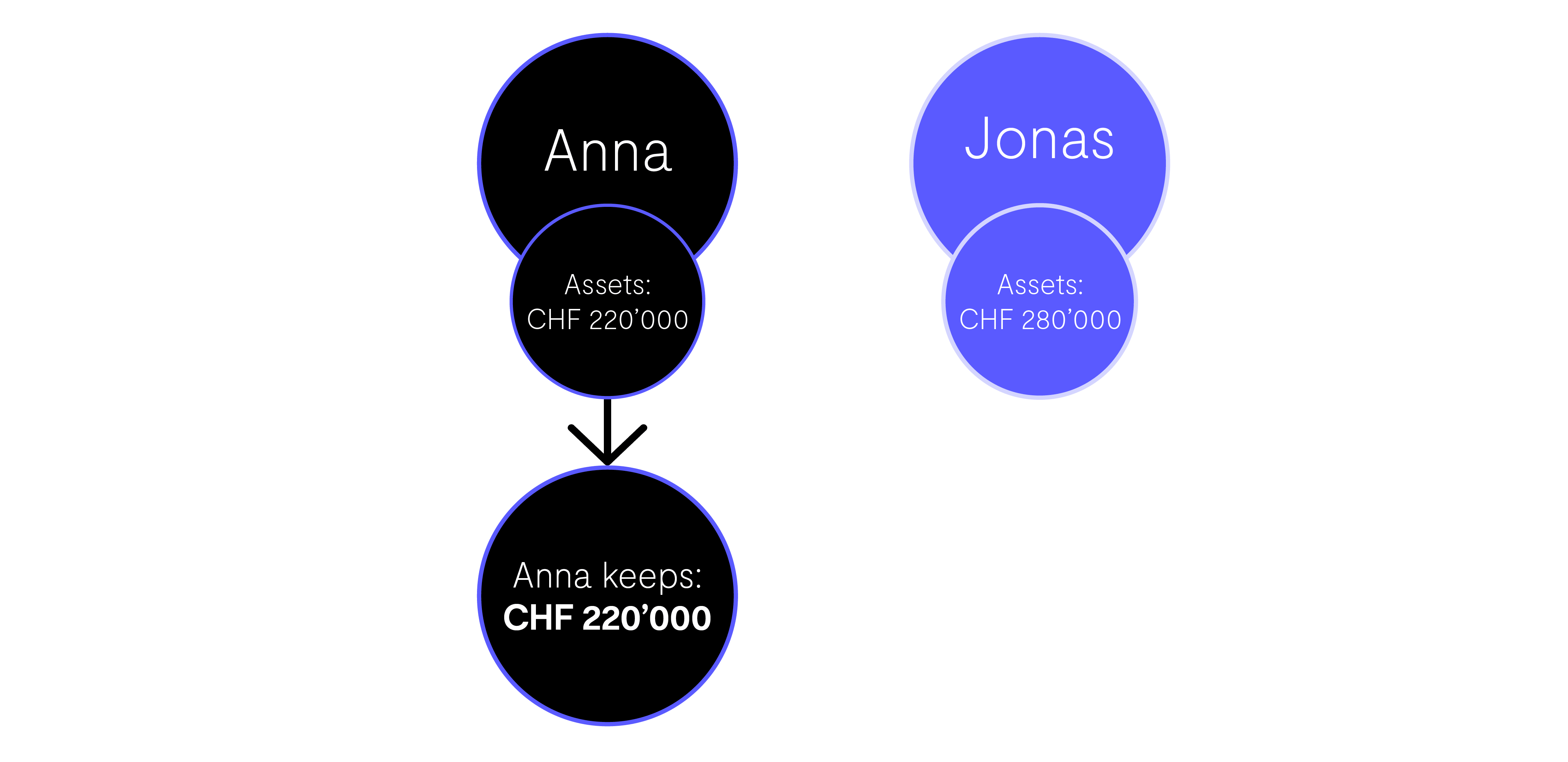

For a cohabiting couple, this means that in principle Jonas and Anna can simply go their separate ways. Legally, they owe each other nothing and have no claim to each other’s assets. Anna keeps hers and Jonas keeps his. The extra earnings that Jonas has made and invested over the years belong to him. The pension fund and pillar 3a are not divided either.

Cohabitation - Separation

The expert, Jennifer Dürst, says: «If couples do not conclude a marriage contract, they are subject to the ordinary matrimonial property regime of joint ownership of acquired property. With this matrimonial property regime, the legislator wanted to provide a fair solution, particularly for the classic division of roles: The man works and the woman takes care of the housework and family. However, for couples where either both work full-time or one party brings a large amount of assets into the marriage or receives them as an inheritance/gift during the marriage, it may make sense to conclude a marriage contract. Separation of property or a modified version of the division of acquired property can also be sensible options. Many people believe that a prenuptial agreement is always about taking something away from the other person. But this is not the case at all. Such a contract provides clarity and can also be used as a beneficiary.

If you live in cohabitation and remain financially independent, you should make sure that your finances remain clear and separate. Keep separate accounts, make larger purchases alone, divide joint costs equally and keep an inventory of who owns what. This makes separation much easier.»

Scenario 3: A stroke of fate*

Jonas and Anna have now been a couple for 25 years when Jonas dies unexpectedly in a car accident at the age of 59. Anna is 57 years old at the time. Both have worked full-time throughout their relationship. Jonas had saved up assets of 250,000 francs through investments. In addition, there is his third pillar, which now contains 170,000 francs. They have no children.

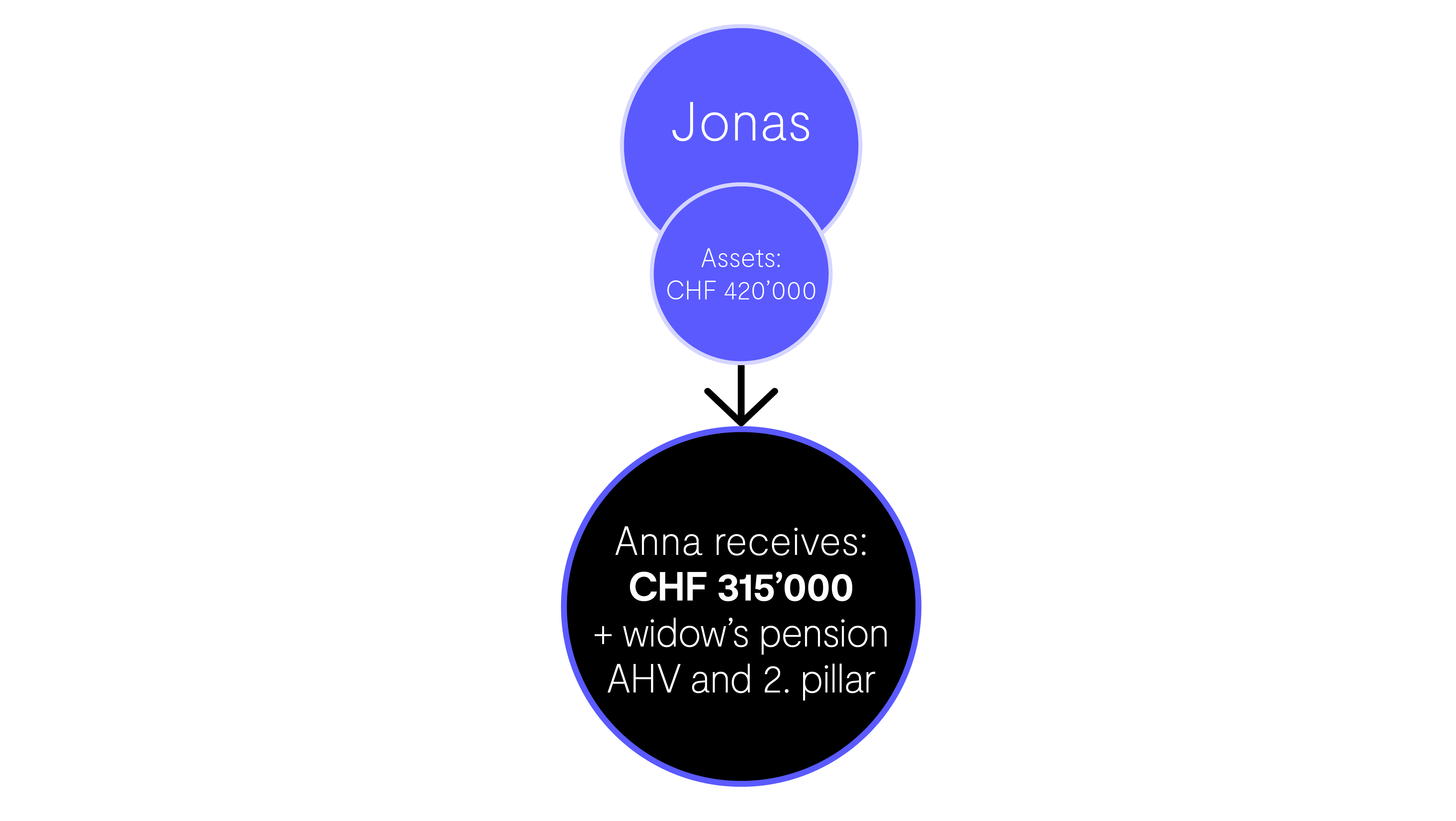

For the surviving wife, this means that as Jonas and Anna have no children and there is neither a will nor an inheritance contract, the majority of Jonas’ assets will go to Anna. 75 percent, to be precise. That's 187,500 francs. Jonas' parents, who are still alive at the time, inherit 25 percent. The money from pillar 3a is also divided in the same way. Anna receives 127,500 francs of this. In addition to the assets, Anna is entitled to an OASI widow's pension and a survivor's pension from the second pillar. The average full AHV pension is between CHF 956 and CHF 1912 per month. It depends on income and how long Jonas has paid in. Anna receives at least 60 percent of Jonas' pension fund assets from his second pillar. Many pension funds are more generous and pay more.

Marriage - Death

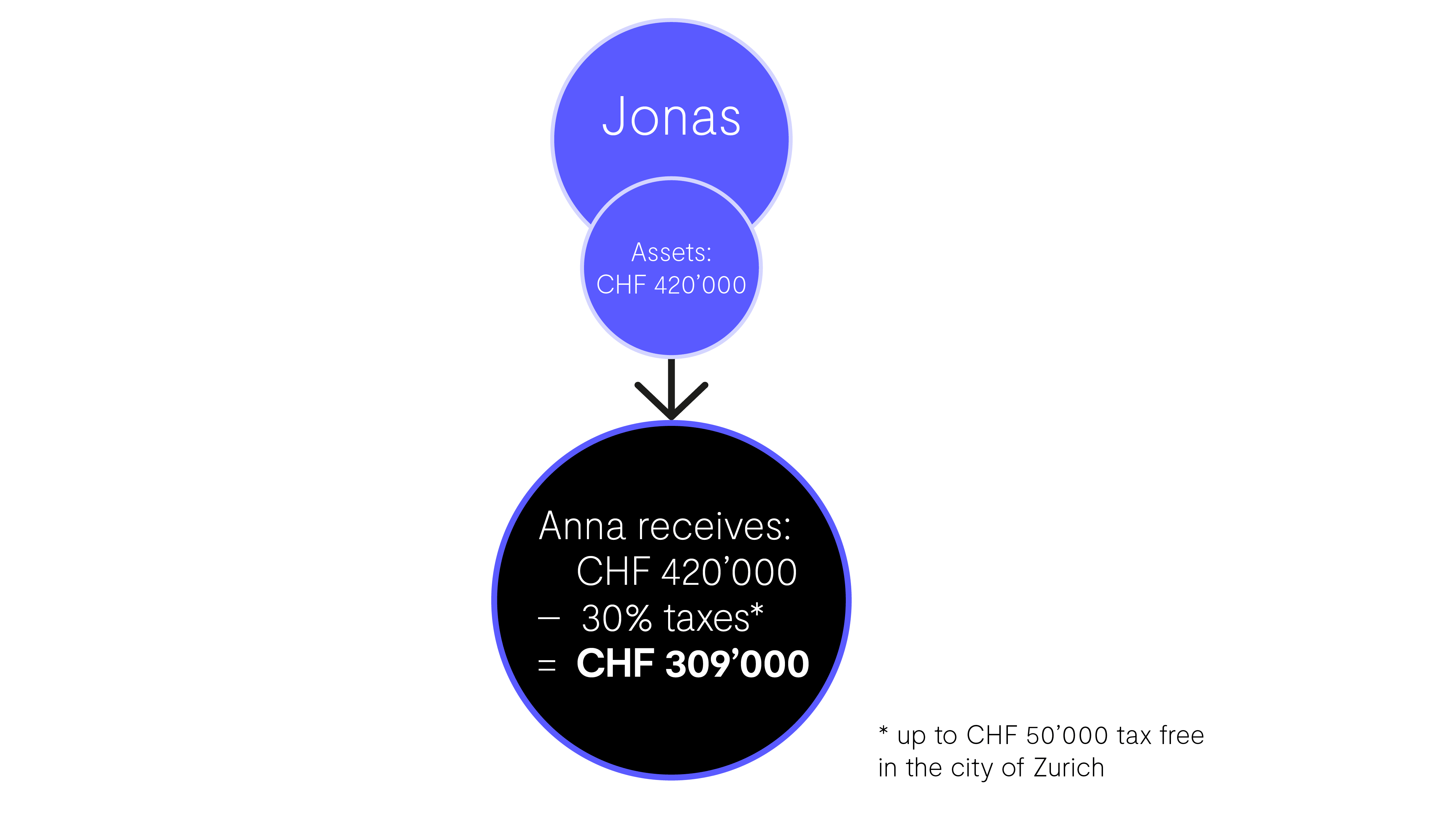

For the surviving cohabiting partner, this means that without a marriage certificate, Anna is basically left empty-handed when Jonas dies. Cohabiting partners have no legal right to inherit. Fortunately, Jonas and Anna finally drew up an inheritance contract two years ago. In it, they named each other as their sole heirs. They also made each other beneficiaries for the pension assets from the second and third pillars.

Cohabitation - Death

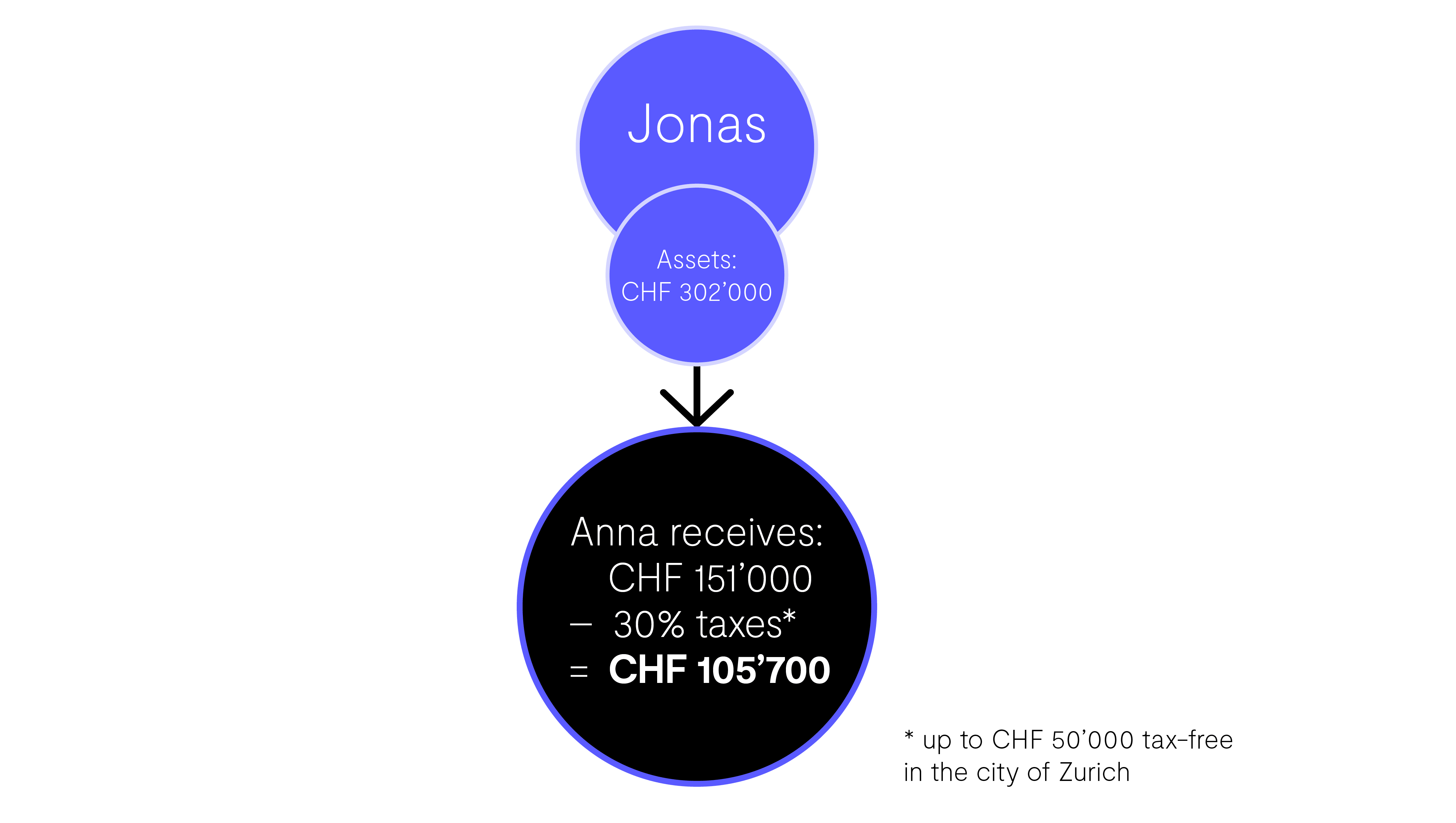

Anna is relieved that she is financially secure. However, as the couple lives in the city of Zurich, Anna has to pay inheritance tax as a cohabiting partner. The rate is between 12 and 36 percent. CHF 50,000 from the inheritance is tax-free. In addition, Anna is not entitled to an AHV widow's pension.

As a married couple, it makes sense to draw up a will or an inheritance contract; in a cohabiting couple, it is virtually obligatory if you want your partner to receive something. Whether you make a will or an inheritance contract depends on how binding you want the document to be. An inheritance contract can only be amended if all parties involved agree to the change and sign the amended contract. An executor can be named in a will to implement the will. Important to know for cohabiting couples: Even if you can benefit each other, the heir may have to pay high inheritance tax depending on the canton. As a spouse, however, you are exempt from this.

Scenario 4: The family has lost its spark

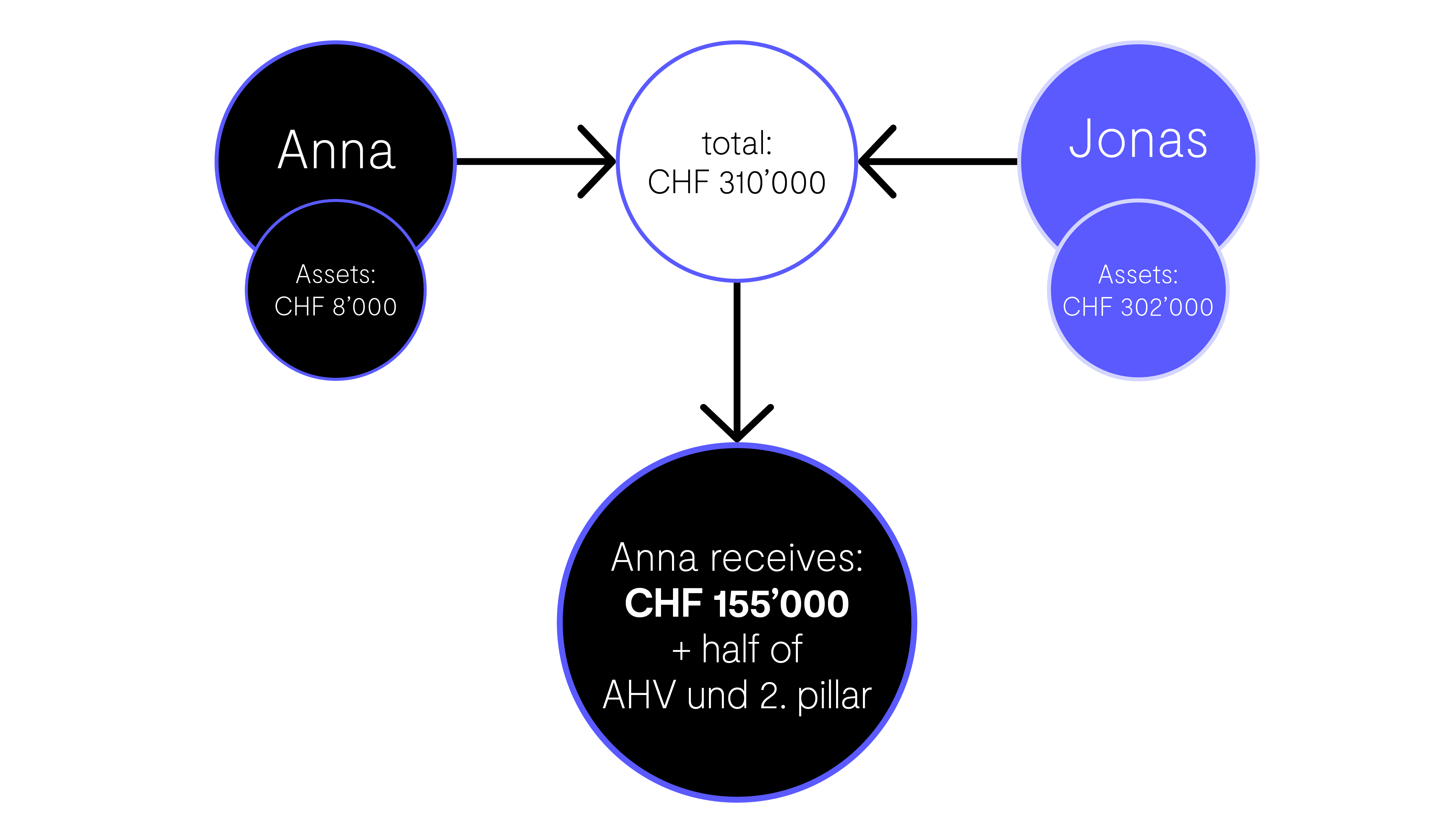

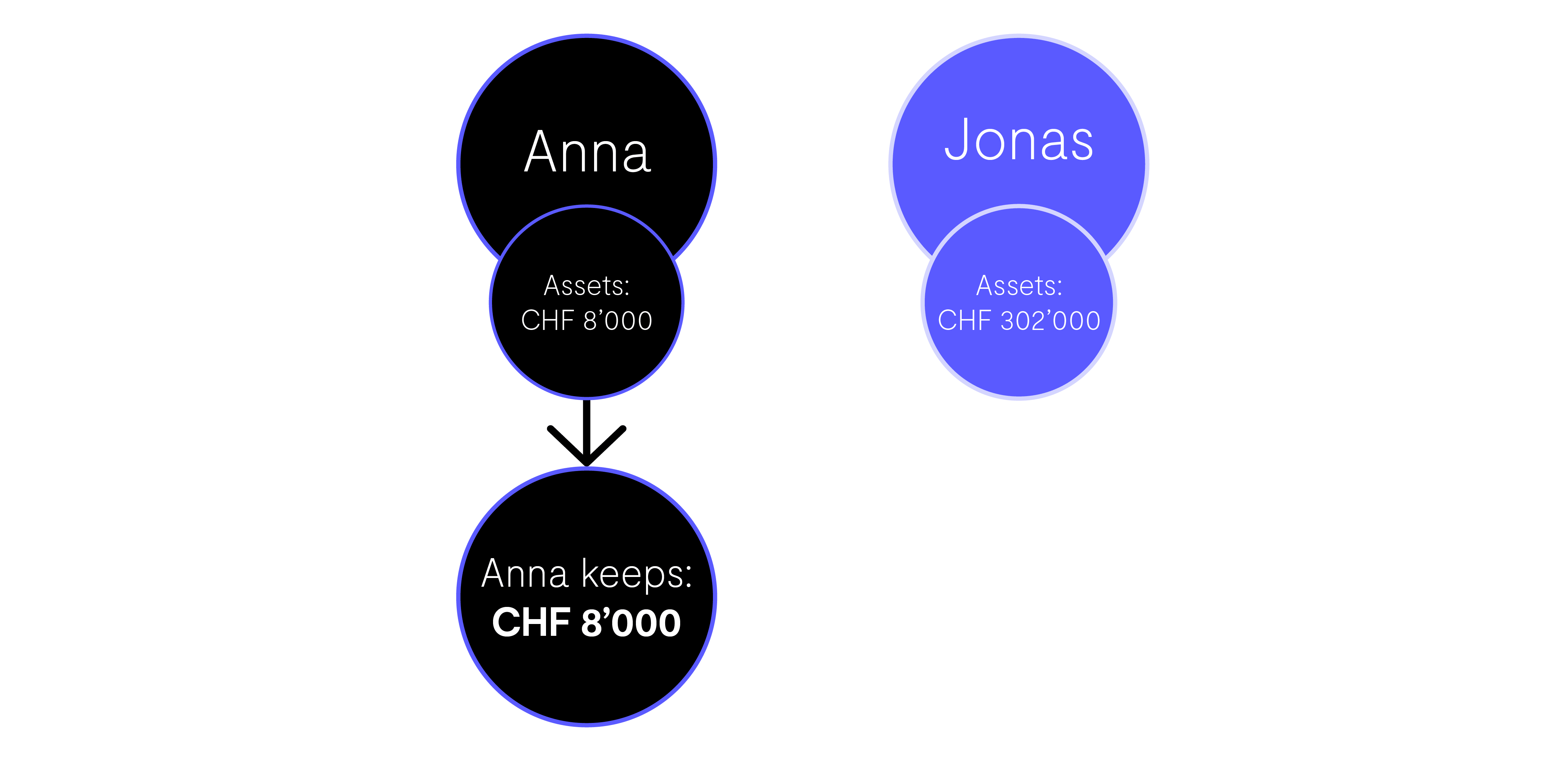

Anna and Jonas realized early on that they wanted to start a family. After a short time, this wish is fulfilled and they have a daughter, followed three years later by a son. Because Anna invests more time in family work, she works part-time with a 40 percent workload. Her annual income is 32,000 francs. Jonas works full-time and is climbing the career ladder. His annual income is 110,000 francs. After twelve years, Anna and Jonas realize that their relationship has lost its spark. They decide to separate. Anna is 44, Jonas 46 years old. Their children are ten and seven years old. Financially, the couple had drifted apart: saving was practically impossible for Anna with her part-time workload. Her assets amount to just under 8,000 francs. She does not have a pillar 3a. Jonas, on the other hand, has invested and made provisions. His assets amount to CHF 220,000 and he has around CHF 82,000 in his pillar 3a.

As a married couple, this means that Anna and Jonas are getting divorced. As they did not conclude a prenuptial agreement when they got married, the division of assets applies. Everything earned during the marriage is divided 50:50 during divorce. Anna therefore receives CHF 114,000 from the joint assets and CHF 41,000 from Jonas' pillar 3a. Both are entitled to half of the other's pension fund and AHV assets that were saved during the marriage. This is advantageous for Anna. Due to her part-time work, she has been able to pay significantly less into the first and second pillars in recent years. The division gives her a small compensation for her unpaid family work. As Jonas earns significantly more than Anna, he will have to pay maintenance for both the children and Anna. The amount of the contributions must be clarified in mediation or court proceedings. This decision is influenced, among other things, by the fixed costs and living expenses that Anna and Jonas have had to date. Another key factor is how Anna and Jonas divide up the care of the children. If Anna - as before - takes over the main part, Jonas will have to pay more than if the two of them split the care.

However, the fact that Anna and Jonas were married does not mean that Anna will now receive lifelong maintenance payments from Jonas. The Federal Supreme Court has amended this practice in several rulings. This means that maintenance payments until retirement are a thing of the past, even for married couples.

Marriage with children - Divorce

As a cohabiting couple, this means a risk of poverty. Because Anna and Jonas decided not to get married, Anna receives nothing from the assets Jonas has saved up over the last 15 years when they separate. And she is also left empty-handed when it comes to retirement provision: She is not entitled to a share from his pension fund, nor will she receive a share from his pillar 3a or AHV. After the separation, Jonas has to pay maintenance for the children. Part of these will also go to Anna, provided she is the main carer of the children. The amount of these contributions will be clarified in mediation or in court and set out in a maintenance agreement. Nevertheless, the separation is financially bitter for Anna. She is now left with assets of 8,000 francs. She also has gaps in her pension fund because she has paid in very little over the past ten years. There is no compensation for these gaps. Anna is annoyed that she and Jonas never managed to draw up a cohabitation agreement. In it, they could have agreed compensation payments for Anna's care services or pension provision. This would at least put Anna in a slightly better financial position. However, she would have to pay gift tax on these payments, which can be very high depending on the canton.

Cohabitation with children - Separation

This is what the expert, Jennifer Dürst, says: «As soon as there are children involved and one partner takes significantly more care than the other, I recommend getting married. Marriage is a better safeguard in such cases. For couples in which one partner takes on more care and family work, I recommend the matrimonial property regime of joint ownership of acquired property and joint property. This protects the financially weaker party - often the wife - in the event of a divorce. She is entitled to half of the assets and pension provision generated during the marriage. This amount is intended as compensation for the family work performed.

Cohabitation has major gaps here and puts the partner providing care at a disadvantage. In a cohabiting couple, the carer has no entitlement to the assets or pension provision that the partner who is mainly gainfully employed has saved up during their time together. In the event of separation, there is the possibility of a care and maintenance agreement. However, as soon as the financially weaker partner earns more than around CHF 3,500, the obligation to pay maintenance for childcare no longer applies. Then there is only the so-called cash maintenance for the everyday costs of the children. In a marriage, partners are generally entitled to maintenance in the event of a divorce, provided the children are still young and a classic division of roles has been agreed. Unmarried couples can regulate certain points in a cohabitation agreement, for example the distribution of family costs or the care of the children. However, such a contract is relatively rigid and only ever reflects a current situation, which can change regularly and quickly in families with children.»

Scenario 5: A stroke of fate for the family

Anna and Jonas have had a picture-perfect relationship for twelve years: a happy couple, a daughter and a son aged ten and seven. Anna spends a lot of time with her family and works part-time at 40 percent. Her annual income is 32,000 francs. Financial matters are not so important to her. She has 8,000 francs in her savings account. She only provides for her retirement with her first and second pillars. Jonas works full-time and has an annual income of 110,000 francs. He bears the majority of the family's costs and always invests some money: he has accumulated assets of 220,000 francs. He has also invested 82,000 in a pillar 3a. One evening, news comes out of nowhere that changes everything: Jonas has had a fatal accident on his way home from the office.

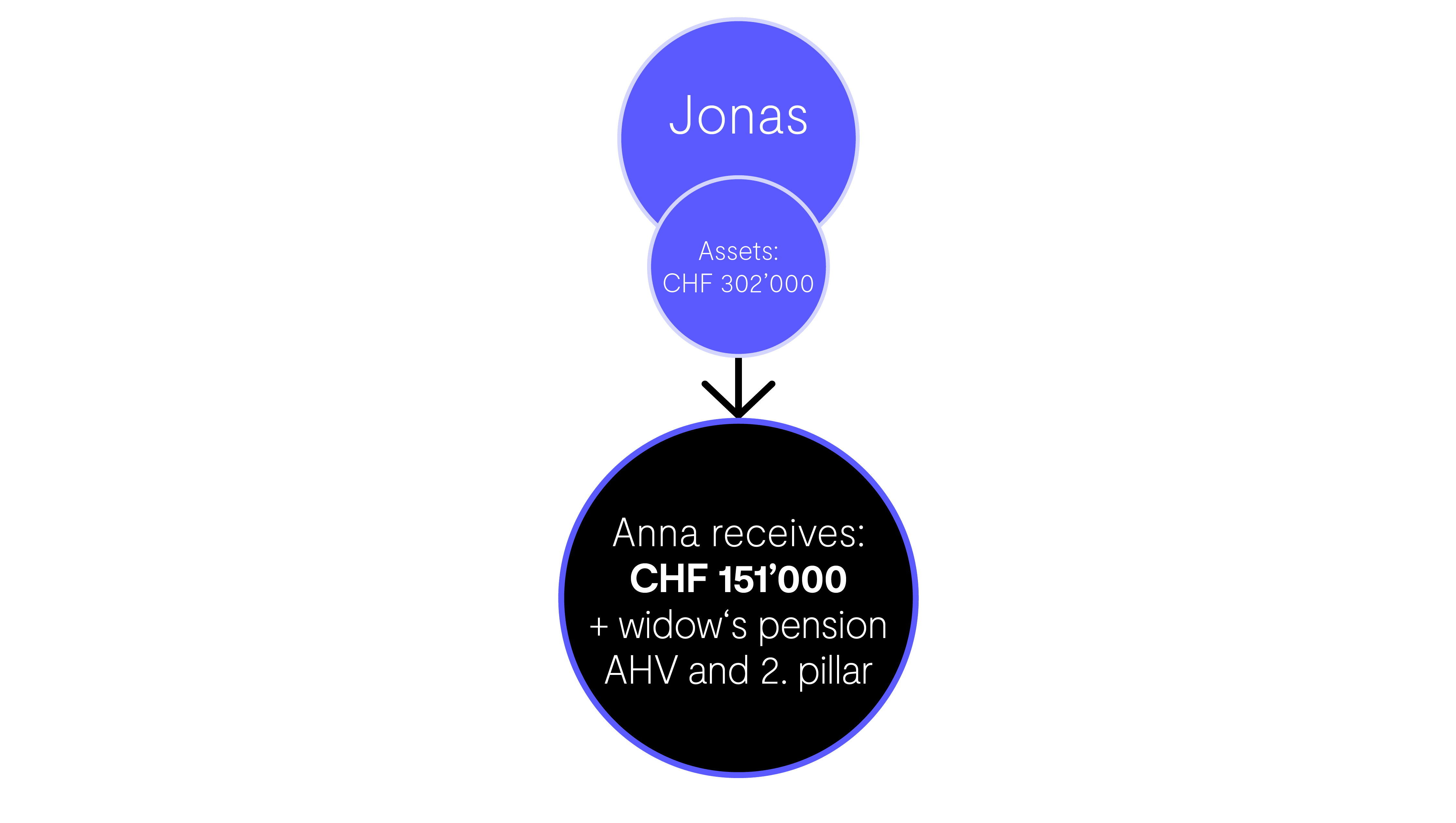

For the surviving spouse, this means that without a will, anna as his wife receives half of Jonas’ assets and his pillar 3a, i.e. CHF 151’000. For the surviving spouse, this means that without a will, Anna as his wife receives half of Jonas' assets and his pillar 3a, i.e. CHF 151,000. The other half goes to the two children. They each receive 75,500 francs. Anna also receives a widow's pension from the first and second pillar. For the second pillar, this is at least 60 percent of the assets. The AHV pension is between 956 and 1912 francs per month. It depends on Jonas' income and how long he has paid in. The children also receive orphan's pensions. They are entitled to 20 percent of the capital in the second pillar and 40 percent of the retirement pension in the first pillar. They receive this money until they are 18 or 25 years old, depending on whether they are still in education or not.

Jonas could have protected Anna even better: with a will. He could have reduced his children to the compulsory portion and left Anna a little more. The compulsory portion for children is currently ⅜, from January 1st, 2023 it will be ¼.

Marriage with children - Death

For the surviving cohabiting partner, this means that Jonas and Anna have provided for the worst-case scenario with a will. Without the will, Anna would be left empty-handed as a cohabiting partner. All of Jonas' assets would go to the underage children. Even with the will, Anna would only receive half, with the other half going to the children as the compulsory portion to which they are entitled. This part may not be violated in a will either. Jonas has also made provisions for the second pillar. Although Anna does not receive a widow's pension as a partner, she does receive a death benefit amount. The amount depends on the fund. Anna does not receive an AHV widow's pension. And then there are the taxes: As Anna and Jonas live in the canton of Zurich, Anna has to pay taxes of between 12 and 36 percent on the inheritance.

Cohabitation with children - Death

This is what expert Jennifer Dürst says: «For cohabiting couples, it's clear: the estate must be settled, otherwise the partner who remains behind has no claim at all. For cohabiting partners, the claim to the inheritance remains limited, especially with children, and they have to reckon with sometimes high inheritance taxes. So here, too, they are at a clear disadvantage compared to spouses. I also recommend that spouses regulate their estate in a will or inheritance contract. For example, the order of succession can be regulated, i.e. the question of who gets how much and, for example, should the children only receive the compulsory portion. You should also specify who should execute your will. A clearly expressed will can make many things easier for the surviving dependants.»

*For transparency: We have republished this article with the revised inheritance law that has been in force since Januar 1st, 2023